Snowflake (NYSE: SNOW) [Made huge strides](www.example.com) in Friday’s trading, with the company’s share price soaring by 9.4%, according to data from S&P Global Market Intelligence.

In the absence of any company-specific news, Snowflake’s valuation flourished on the back of impressive earnings reports from major cloud services providers. Amazon’s exceptional fourth-quarter results, in particular, served as a catalyst for the surge in Snowflake’s share price

The Bright Prospects of Snowflake Amid Robust Cloud Demand

Snowflake is at the vanguard of providing data-warehousing services and related analytics and data management technologies. Its Data Cloud platform facilitates the amalgamation of information generated across the cloud infrastructure services of Amazon, Microsoft, and Alphabet‘s cloud infrastructure services. Therefore, the robust demand for the leading cloud infrastructure providers augurs well for Snowflake’s performance.

Amazon revealed its fourth-quarter report after the market closed yesterday, with sales soaring by a remarkable 14% year over year to touch $170 billion, significantly surpassing the average analyst estimate of $166.2 billion. The company’s Amazon Web Services (AWS) division witnessed a 13% year-over-year increase, reaching $24.2 billion.

Amazon’s robust Q4 report followed Microsoft’s better-than-expected results earlier in the week. For the second quarter of the current fiscal year, concluding at the end of December 2023, Microsoft recorded revenue of $62.02 billion, outstripping Wall Street’s projection of $61.12 billion for the period. The software giant’s revenue surged by 18% year over year, and sales for its Azure infrastructure business and other cloud services jumped by 30% year over year.

Assessing Snowflake Stock’s Appeal

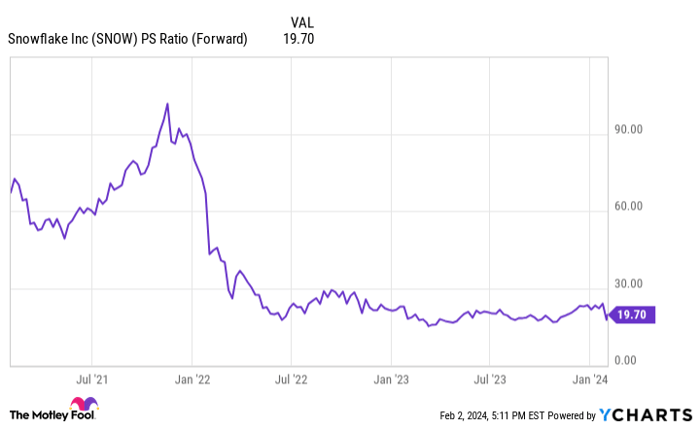

Amid the fervor surrounding artificial intelligence (AI) and an improving demand outlook for key cloud businesses, Snowflake stock has witnessed robust momentum, yet it still trades nearly 46% lower than its peak in 2021.

Currently valued at approximately 20 times this year’s expected sales, Snowflake sports a valuation heavily dependent on growth. Ergo, the company’s stock may not be an ideal fit for every investor.

SNOW PS Ratio (Forward) data by YCharts

The company, however, is growing at a rapid clip and is well-positioned to continue playing a pivotal role in the evolution of analytics and AI services. For investors with an appetite for risk, Snowflake stock exhibits the characteristics of a valuable addition to their portfolios. Nevertheless, heavily committing to the stock necessitates gauging one’s personal tolerance for volatility.

Considering investing $1,000 in Snowflake? Before taking the plunge, reflect on this:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the10 best stocks for investors to purchase. Interestingly, Snowflake did not make the cut. Nonetheless, the 10 stocks recommended have the potential to yield tremendous returns in the years ahead.

Stock Advisor furnishes investors with a clear-cut roadmap for success, offering counsel on portfolio construction, regular updates from analysts, and two new stock selections each month. The service has outperformed the S&P 500’s returns by more than threefold since 2002*.

*Stock Advisor returns as of January 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Snowflake. The Motley Fool has a disclosure policy.