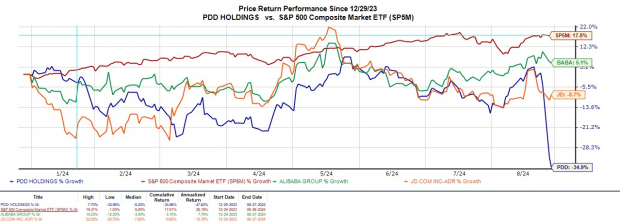

PDD Holdings PDD had been riding high in recent times, displaying remarkable growth. However, its shares plummeted by 30% post the Q2 results announcement earlier this week. The sharp decline followed the company’s acknowledgment of an impending profitability dip, expected to commence from Q3 onwards.

PDD faces tougher competition and broader economic uncertainties in China, despite its ability to grab market share through discounted offerings as compared to other e-commerce giants like Alibaba BABA and JD.com JD.

Image Source: Zacks Investment Research

Reviewing PDD’s Q2 Performance

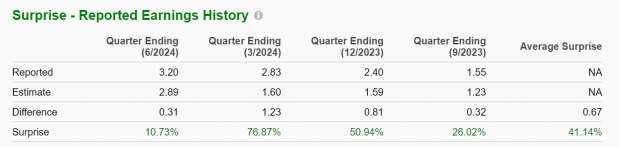

The Q2 sales figure for PDD amounted to $13.35 billion, marginally missing estimates by 2%. Nonetheless, this marked an impressive 85% surge from the $7.2 billion recorded in the same period last year. In terms of earnings, Q2 EPS of $3.20 surpassed expectations by 10% and soared by a remarkable 122% compared to $1.44 per share a year earlier.

Of significance is the fact that PDD has outdone the Zacks EPS Consensus for 14 consecutive quarters, delivering an average earnings surprise of 41.14% over its last four quarterly reports.

Image Source: Zacks Investment Research

Assessing PDD’s Growth Trajectory

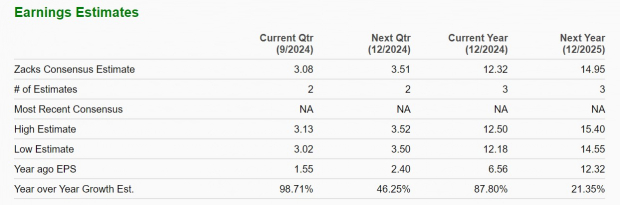

According to Zacks projections, PDD’s total sales are anticipated to surge by 62% in fiscal 2024, reaching $56.27 billion compared to $34.64 billion in the previous year. Further growth is forecasted for FY25, with a projected 27% increase to $71.59 billion.

Annual earnings are expected to witness a remarkable 87% jump this year, climbing to $12.32 per share from $6.56 in 2023. Additionally, FY25 is predicted to see another 21% rise in EPS. However, it is crucial to note that earnings estimates for FY24 and FY25 might start to decline following the company’s caution regarding lower profitability.

Image Source: Zacks Investment Research

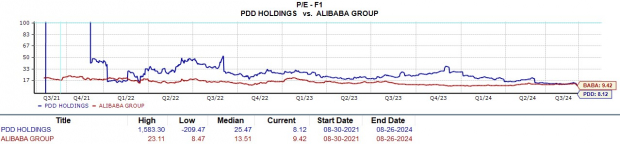

Comparative Valuation Analysis

Currently trading at $95, PDD’s stock carries an 8.1X forward earnings multiple, presenting a notable discount to the S&P 500’s 23.7X valuation. Furthermore, following the recent decline, PDD is now positioned close to Alibaba’s 9.4X valuation, while remaining higher than JD.com’s 6.5X.

Image Source: Zacks Investment Research

Concluding Remarks

In the aftermath of its Q2 financial disclosure, PDD Holdings has been assigned a Zacks Rank #3 (Hold). While the post-earnings decline in PDD’s stock might appeal to investors, the company seems to be treading a path similar to other Chinese e-commerce entities marked by undervaluation and instabilities linked to broader economic uncertainties.

With its promising long-term growth trajectory, PDD remains a viable investment option. However, opportunities for more strategic entries into the market may present themselves in due time.

Exploring Top Semiconductor Stock as per Zacks

It’s merely 1/9,000th the size of NVIDIA that witnessed an extraordinary surge of over +800% since the previous recommendation. Although NVIDIA remains robust, our latest leading chip stock shows immense potential for growth.

With robust earnings expansion and an expanding client base, it stands poised to cater to the escalating demand for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor manufacturing sector is projected to explode from $452 billion in 2021 to $803 billion by 2028.

Explore This Stock Now for Free >>

Uncover a Free Stock Analysis Report of PDD Holdings Inc. Sponsored ADR (PDD)

Access a Free Stock Analysis Report of JD.com, Inc. (JD)

Peruse a Free Stock Analysis Report of Alibaba Group Holding Limited (BABA)