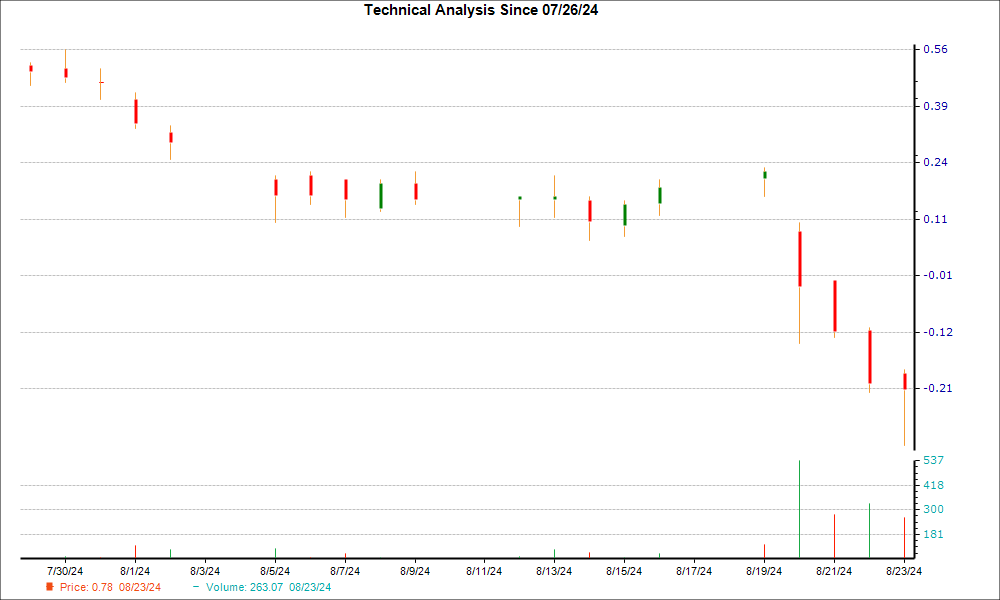

The recent price trend for Workhorse Group (NASDAQ: WKHS) has been on a downward spiral, with the stock plummeting 33.6% in the past week. However, a glimmer of hope emerged as a hammer chart pattern was formed during the last trading session. This pattern suggests a potential reversal in the stock’s trajectory, indicating a shift towards a supportive stance, with bulls gaining momentum.

While the technical indication of the hammer pattern signals a possible bottom nearing, an additional factor boosting investor confidence stems from the increasing optimism among Wall Street analysts regarding the future earnings of this innovative truck and drone manufacturer.

Exploring the Hammer Chart Pattern and Trading Techniques

Within the realm of candlestick charting, the hammer pattern is a widely recognized formation. Characterized by a small candle body with a significant lower wick (or vertical line), the pattern resembles a hammer. In essence, during a downtrend, this pattern suggests a potential reversal, as buying interest emerges to prevent further decline.

A hammer pattern, such as the one observed with Workhorse Group, signifies a struggle between bears and bulls. When this scenario unfolds at the bottom of a downtrend, it serves as a signal that the bears might be losing control, paving the way for a bullish upturn.

While the hammer pattern holds value across various timeframes and appeals to both short-term and long-term investors, it’s essential to complement this indicator with additional bullish signals for a comprehensive analysis.

Favorable Indicators Pointing Towards a Workhorse Reversal

Recent upward trends in earnings estimate revisions for WKHS amplify the bullish sentiment regarding its future performance. Historical data underscores a strong correlation between earnings estimate trends and subsequent stock price movements. Over the past month, the consensus EPS estimate for the current year surged by 22.5%, indicating a positive outlook among sell-side analysts.

Additionally, Workhorse currently boasts a Zacks Rank #2 (Buy), placing it in the top 20% of ranked stocks based on earnings estimate revisions and EPS surprises. Companies with a Zacks Rank of 1 or 2 typically outperform the market, making this a promising sign for Workhorse investors.

The Zacks Rank has historically served as a reliable indicator to gauge a company’s improving prospects, and for Workhorse, a Zacks Rank of 2 further solidifies the fundamental basis for a potential turnaround.

Resounding with optimism and backed by strong technical and fundamental indicators, the Workhorse stock might be on the cusp of a significant transformation, attracting investors seeking opportunities amidst market fluctuations.