Over the past two decades, growth-focused companies have shone brightly in the stock market, capturing the attention and investments of many. Stemming from areas such as medicine, software-as-a-service (SaaS), and alternative energy, these innovators have hinted at a brighter, more revolutionary future ahead.

In recent times, two powerful themes have garnered significant interest from growth investors due to their immense potential: artificial intelligence (AI) and next-generation weight loss drugs. For those looking to dip their toes into these promising sectors, one exchange-traded fund (ETF) emerges as a crystal-clear choice: the Vanguard Index Funds — Vanguard Growth ETF (NYSEMKT: VUG).

Image Source: Getty Images.

The Surging AI and Weight Loss Drug Markets Spark Investor Interest

The global AI market’s projected growth from $196 billion in 2024 to a staggering $1.3 trillion by 2032, with a compelling compound annual growth rate (CAGR) of 26.6%, defines a trajectory that’s hard to ignore. Thriving in this space are industry titans like Nvidia, Alphabet, Microsoft, Adobe, Arista Networks, and Palantir Technologies. However, while Nvidia dominates as the paramount AI infrastructure company, numerous other players in the AI realm boast significant growth prospects.

Meanwhile, the torrentially expanding next-generation weight loss drugs market, anticipated to rocket with a CAGR of 49% from 2023 to 2030, is nothing short of eye-opening. Goldman Sachs’ analysts predict a surge in market value from $6 billion in 2023 to $100 billion by 2030.

Leading the charge in this weighty competition are Eli Lilly and Novo Nordisk. However, several contenders like Viking Therapeutics, Amgen, and Pfizer are gearing up to launch their competitive therapies before the decade draws to a close.

How Vanguard Growth ETF Aligns with the Emerging Market Trends

Packed with shares from the biggest and fastest-growing companies in the AI and weight loss drug markets, the fund presents a tantalizing mix of high potential for capital growth. Notwithstanding the robust prospects, it carries higher risk compared to more diversified index ETFs like the Vanguard S&P 500 ETF.

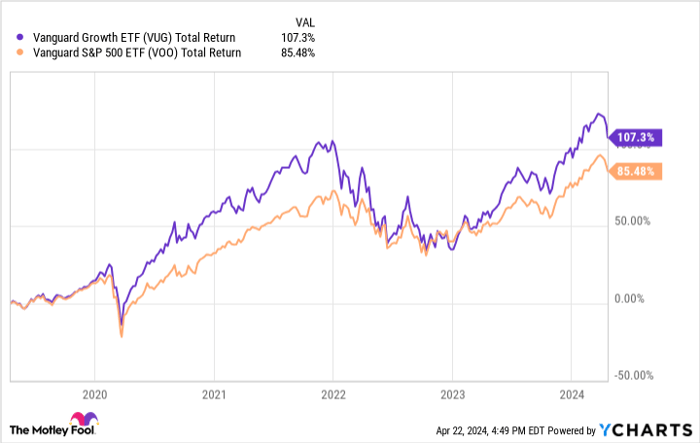

The Vanguard Growth ETF has unfailingly outperformed the S&P 500 in recent times, owing to its substantial exposure to companies within the AI and weight loss medication realms. The visually depicted graph below serves as an apt illustration of this outperformance:

VUG total return level data by YCharts.

Adding to its allure, the ETF boasts an ultra-low expense ratio of 0.04%, significantly lower than the category average. The fund also provides a modest yield of 0.53%, effectively covering associated fees. With a stellar 10-year average annual gain of 15.07%, it proudly stands among Vanguard’s premier large-cap funds over this period.

When delving into its holdings, the top five positions include Microsoft, Apple, Nvidia, Amazon, and Meta Platforms — all at the helm of the AI revolution. Eli Lilly, creator of the weight loss drug Zepbound, occupies the eighth-largest spot in the fund’s portfolio.

However, the fund does sport a single grey cloud — its lack of high diversification. Holding shares in merely 199 companies, it boasts a more streamlined portfolio compared to several other large-cap growth ETFs. Nevertheless, it emerges as a safer bet than investing in individual stocks.

Final Reflections

The ETF presents itself as an inviting portal into the vast growth opportunities within AI and weight loss drug stocks. Bolstered by the traditional virtues of diversification and adept management emblematic of Vanguard funds, it offers a promising avenue for investors looking to seize the bull by the horns in these potent markets going forward.

Furthermore, the Vanguard Growth ETF provides a simple and cost-effective methodology to invest in these dynamic sectors, obviating the need for painstakingly selecting individual stocks. This Vanguard fund, therefore, emerges as an obvious gem beckoning investors towards a brighter investment horizon.

Is Now the Time to Invest in Vanguard Growth ETF?

Prior to investing in the Vanguard Growth ETF, it’s prudent to consider the following:

The Motley Fool Stock Advisor analyst team recently unveiled their top10 stocks expected to yield monumental returns in the years to come… and Vanguard Growth ETF didn’t make the cut. The 10 chosen stocks hold the potential for substantial returns moving forward.

Stock Advisor equips investors with a straightforward roadmap to success, offering guidance on portfolio construction, regular analyst updates, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has tripled the returns of the S&P 500.

*Stock Advisor returns as of April 22, 2024