Earnings season always offers a captivating peek behind the corporate curtain, revealing the financial maneuvers of various companies.

This week, attention is riveted on the quarterly releases of three prominent companies: Netflix (NFLX), American Express (AXP), and Taiwan Semiconductor (TSM).

Netflix

For the streaming giant Netflix, all eyes are on subscriber metrics. Analysts predict a Net Membership Additions figure of 5.2 million, a substantial leap from the previous year’s 1.7 million.

Netflix has been consistently surpassing expectations in this area, with the latest beat registering 4.2 million new subscribers.

Image Source: Zacks Investment Research

Analysts are bullish on Netflix, with a Zacks Consensus EPS estimate of $4.49, indicating a 12% increase since mid-January and a projected 56% year-over-year growth.

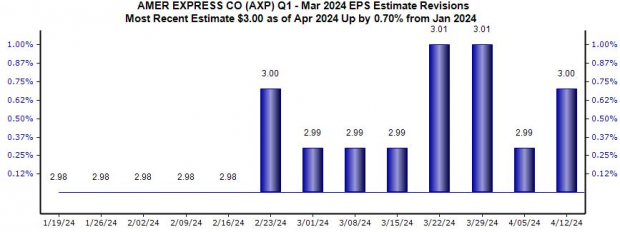

American Express

American Express, the financial powerhouse, has seen a modest rise in the Zacks Consensus EPS estimate to $3.00. Revenue expectations remain steady, reaching $15.7 billion, a 10% upsurge from the previous year.

Image Source: Zacks Investment Research

Notably, AXP shares have outperformed, rising by 17% year-to-date, surpassing the S&P 500’s 8.0% gain.

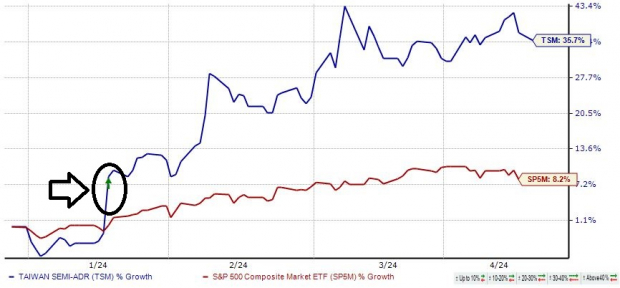

Taiwan Semiconductor

Taiwan Semiconductor, a darling of investors, has experienced a significant uptick in its shares, primarily due to the AI frenzy. Its stock has surged by 36% year-to-date, outperforming the S&P 500.

Image Source: Zacks Investment Research

For TSM, analysts forecast a Zacks Consensus EPS estimate of $1.29, signaling a slight dip from the previous year. Revenue predictions are more optimistic, with a 6% increase over the same period.

Bottom Line

The thrill of earnings season lies in companies unveiling their financial performance, shedding light on their operations.

This week, all eyes are on Netflix (NFLX), American Express (AXP), and Taiwan Semiconductor (TSM), promising insights into the market’s dynamics.

Zacks Names “Single Best Pick to Double”

From a plethora of stocks, Zacks experts have cherry-picked one stock with the potential to skyrocket by more than 100%. This American AI company, with clients like BMW and GE, shows promise for significant growth in the coming year.

While not all picks are home runs, this stock could surpass previous Zacks’ successes like Boston Beer Company, which skyrocketed by +143.0% in under 9 months, and NVIDIA, which boomed by +175.9% in a year.