With Amazon’s stellar performance leading a market rally following reassuring words from Fed Chair Jerome Powell, Apple also dazzled investors by surpassing Q2 expectations yesterday evening, raising the bar for competitors.

Apple’s financial numbers showcased a glittering display, with Q2 EPS soaring to a record $1.53, nudging past estimates and marking a 1% uptick from the previous year. Despite a decline in sales from the previous year, international markets such as Canada, Latin America, and the Middle East shone brightly, propelling Apple’s Q2 sales to $90.75 billion, surpassing estimates by 1%.

In a remarkable streak, Apple has now outperformed analyst predictions for five consecutive quarters, boasting an average earnings surprise of 4.14% in its last four quarterly reports.

Image Source: Zacks Investment Research

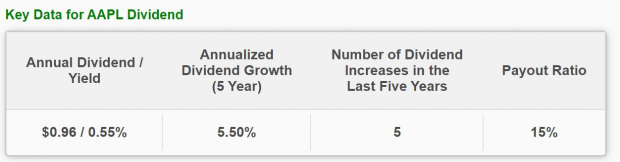

Bountiful Returns and Buybacks

Apple’s confident outlook led its board to greenlight an additional $110 billion for stock repurchases, aiming to achieve cash neutrality. Furthermore, Apple announced a 4% dividend increase to $0.25 per share, coupled with plans for continuous annual payout hikes.

Image Source: Zacks Investment Research

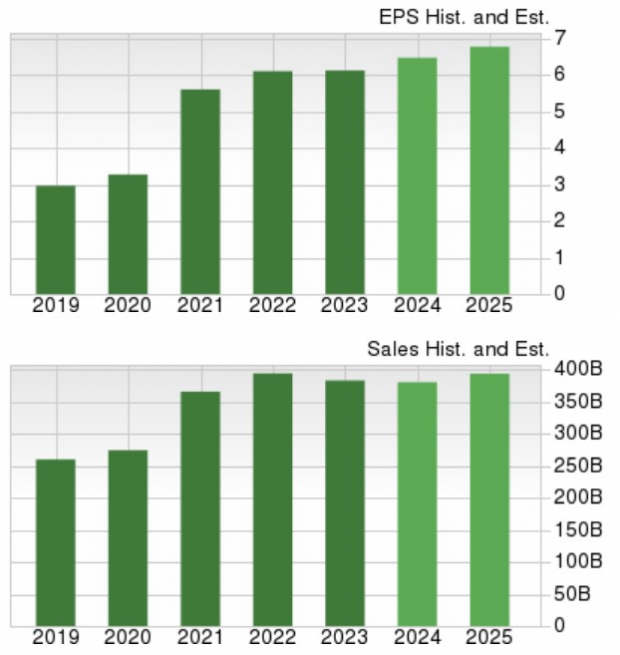

Charting Growth Trajectory

Zacks projects a steady ascent for Apple, estimating a 6% increase in annual earnings for fiscal 2024 and a further 8% rise in FY25, pegging it at $7.10 per share. Though total sales are anticipated to remain nearly flat this fiscal year, a 5% upsurge is expected in FY25, reaching $403.72 billion.

Image Source: Zacks Investment Research

Final Thoughts

Despite recent concerns, Apple’s resilience and global expansion efforts paint a promising picture. While hurdles may lie ahead, potential opportunities for strategic investments in Apple’s stock seem within sight.

Bitcoin: The Golden Egg?

In the realm of investments, Bitcoin outshines its peers like a dazzling gem. Over the past three presidential election years, Bitcoin has outshone conventional assets, boasting impressive returns: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. With Zacks predicting another significant surge on the horizon, investors are keeping a close eye on this digital goldmine.