Tesla’s Recent Market Performance

After a lackluster beginning to the year, Tesla’s shares have embarked on a remarkable journey, surging by 54% in just the past 3 months. The catalysts behind this spectacular rise include investor approval for CEO Elon Musk’s pay package, surpassing Q2 delivery expectations, and optimistic discussions regarding Tesla’s potential as an AI powerhouse.

Expanding Beyond Automobiles

While Tesla’s primary focus has traditionally been on manufacturing and selling electric vehicles, the ongoing debate revolves around whether the company should be viewed and valued as a tech entity rather than merely an automotive manufacturer.

The Complexity of Valuing Tesla

UBS analyst Joseph Spak acknowledges Tesla’s intricate identity, recognizing it as more than just a car company. He highlights positive growth in areas such as Energy and Full Self-Driving (FSD) technology, which contribute to its current valuation. However, properly assessing the value of Tesla’s potential for future growth proves to be challenging. The recent premium surge, largely driven by enthusiasm around AI, has accentuated this difficulty.

Analyst’s Downgrade and Contradictory Price Target

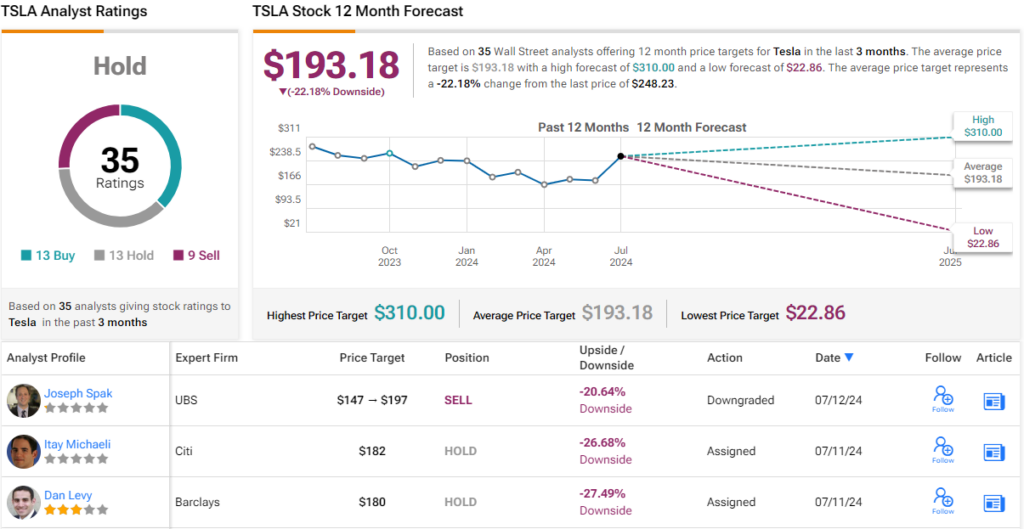

Spak downgrades Tesla’s rating from Neutral to Sell due to the lack of visibility and the extended timeline for growth opportunities. Despite the Sell rating, he raises the price target from $147 to $197. This adjustment still implies that Tesla’s shares are overvalued by approximately 21%.

Uncertainties and Potential Upsides

Spak admits the potential for Tesla’s stock price to detach from fundamentals, which could persist. Positive Q2 results may exceed expectations, prompting upward revisions for 2025 and 2026 forecasts and sustaining momentum. Additionally, anticipation surrounding the “robo-taxi” event could deliver an unexpected upside surprise.

Market Consensus

With 8 analysts siding with Spak’s bearish sentiment and 13 others opting for Buys and Holds each, Tesla stock holds a consensus Hold rating. The $193.18 average target price implies a 22% discount from the current levels, projecting a future pivot.

To identify stocks with compelling valuations, explore TipRanks’ Best Stocks to Buy tool, consolidating diverse equity insights.

Disclaimer: This article reflects the viewpoints of the highlighted analyst for informational purposes only. Independent analysis is strongly advisable before making any investment decisions.