Blocking out the noise and focusing on the essence of a situation is an indispensable skill for anyone diving into the tumultuous waters of investment. The case of Alibaba (BABA) exemplifies this perfectly, as the latest fiscal train has hit some bumps, yet hidden treasures lie beneath the surface. Hence, my optimistic stance on BABA stock remains unwavered, with the notion that the company’s financial robustness shines brightly amid the challenging landscape in China.

Think of Alibaba as China’s counterpart to Amazon (AMZN) in the United States, but bracketing Amazon’s expectations onto Alibaba is akin to leading a camel through the eye of a needle. China boasts a temperamental economy, post the ease of COVID-19 lockdowns in late 2022, coupled with the ever-bothersome property market woes.

Decoding Alibaba’s Recent Performance

Alibaba’s financial standings for the second quarter of 2024 spell a tale of increased turbulence. Operating income took a harsh 15% tumble year-over-year to $4.952 billion. Net income witnessed a steeper decline, plunging 27% to $3.306 billion. Gloomy, right?

The optics shift when we analyze the adjusted (non-GAAP) earnings for Q2-2024, which stood at $2.26 per ADS – a mere 5% downturn from the previous year. Meanwhile, adjusted (non-GAAP) EBITA only slightly receded by 1% to $6.197 billion. However, while one can grasp at straws for positivity, it’s discomforting to note that Alibaba’s adjusted net profit showed a sharp 9.4% dip to 40.69 billion yuan. Despite this plunge, analysts’ earnings predictions were surpassed, holding onto a glimmer of hope.

Surprisingly, Alibaba’s press release remained reticent on the reasons behind the substantial decline in net income. Hiking expenditures in marketing, product development, administrative overhead, and a spike in taxes took their toll, forming a cloud of uncertainty over the company’s future fiscal trajectory.

Unearthing Alibaba’s Bright Spots

The brighter side of Alibaba’s tale reveals a sturdy backbone in the second quarter of 2024 that more than compensates for the gloomy bits. Alibaba’s Cloud Intelligence Group revenue notched a 6% upsurge year-over-year, fueled by a double-digit rise in public cloud activity and the thriving adoption of AI-related products.

No less impressive, the count of paying users on Alibaba Cloud’s AI platform skyrocketed by over 200% in Q2 2024 versus Q1 2024. Twining technology with e-commerce, Alibaba’s International Digital Commerce Group waltzed in with a 32% revenue surge to $4.031 million, possibly hinting at a profitable Q2 2024 had capital injections in marketing and product development been reined in.

A trait that sets Alibaba apart is its penchant for share buybacks. The company repurchased a staggering 613 million ordinary shares in the second quarter of 2024, summing up to $5.8 billion. This significant move potentially curtails the share supply, a move that might give wings to the share price. By June 30, 2024, Alibaba had 19,024 million ordinary shares outstanding, marking a net decrease of 445 million shares from the count on March 31, 2024.

Analysts’ Take on Alibaba Stock

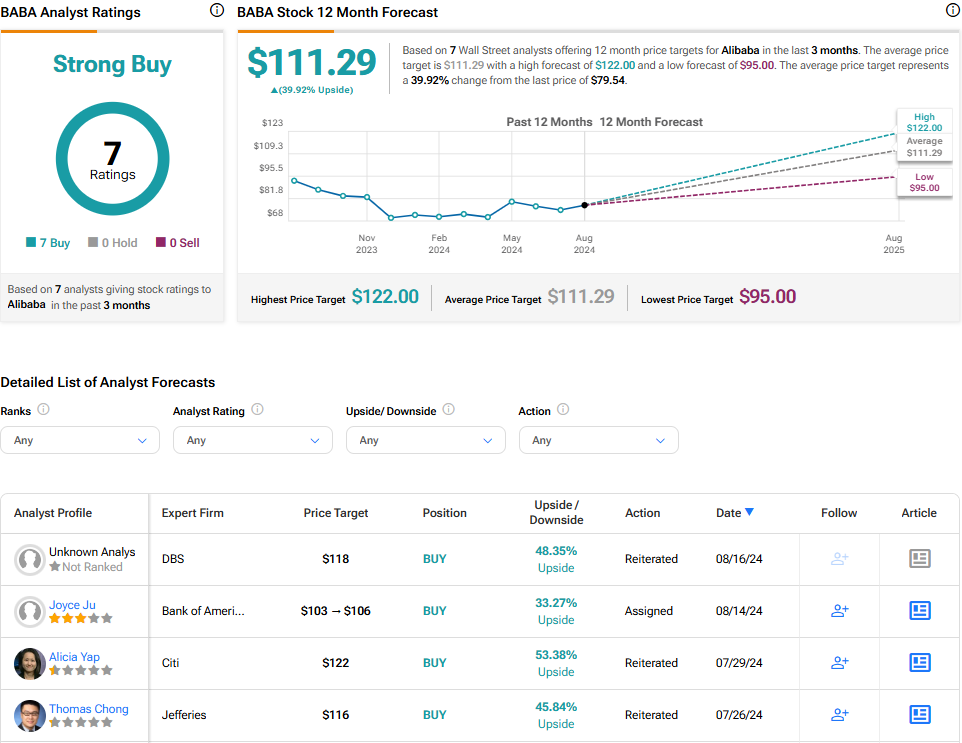

Scanning the analyst landscape on TipRanks, Alibaba (BABA) emerges as a Strong Buy, upheld by seven unanimous Buy ratings in the past three months. The estimated price target for Alibaba stock averages $111.29, hinting at a substantial 39.9% upside potential.

Discover more BABA analyst ratings

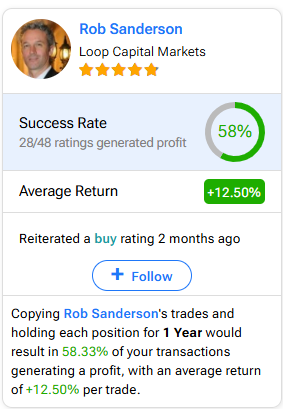

For those pondering which analyst’s voice to heed in the BABA stock realm, Rob Sanderson from Loop Capital Markets emerges as the most profitable analyst, recording an average return of 12.5% per rating and a 58% success rate on a one-year timeline.

Wrapping Up: Unveiling Alibaba Stock’s True Potential

The market greeted Alibaba’s quarterly revelations with a nonchalant shrug, leaving the stock price barely perturbed. The market’s tepid response might signify a contemplation phase, juggling Alibaba’s mixed bag of news.

However, in the grand scheme of things, Alibaba’s virtues are poised to take the center stage. Delve into the depths of Alibaba’s results, particularly focusing on the Cloud AI platform and the International Digital Commerce Group. Top that off by acknowledging Alibaba’s substantial share repurchases. With these insights in mind, it might just be the opportune moment to sideline the naysayers and consider indulging in BABA stock today.