Investors often walk on eggshells when considering pre-earnings stock purchases. It’s like navigating a minefield – one wrong step, and it could all blow up in your face. The upcoming earnings report from Ford Motor is casting a shadow of doubt over its stock. As a cautious observer, the outlook on Ford isn’t exactly rosy due to the company’s recent sales performance.

Ford Motor, a veteran in the automotive industry, provides a wide range of vehicles from traditional to electric. While boasting a respectable dividend, a closer look reveals its shares may be deceptively low-priced.

However, a low price-to-earnings ratio and an attractive dividend yield don’t always spell good news. For an automaker like Ford to thrive, it needs to show substantial sales growth – a department where Ford seems to be hitting some speed bumps.

Proceed with Caution: Ford’s Value-and-Yield Quandary

Ever heard of value traps or yield traps? Well, Ford might be treading in dangerous waters. Let’s dissect Ford’s specifics and see if it’s heading into a value-and-yield quagmire with its stock.

Ford currently sports a non-GAAP trailing 12-month P/E ratio of 6.77x, significantly below the sector median of 14.98x. Additionally, it offers a tempting forward annual dividend yield of 7.05%, far exceeding the Consumer Cyclical Sector Average.

But hold your horses – a company can sport a low P/E and a high dividend yield, just like Ford, when its stock price takes a nosedive. Remember when F stock crashed from $14.50 to $11? Such sharp declines can skew P/E ratios and dividend yields, warranting a cautious approach to trading Ford stocks at the moment.

Ford’s Earnings Call: A Crucial Test

Earnings reports have the power to catapult a stock to unseen heights or send it plummeting to the depths. Despite the impending third-quarter 2024 financial results announcement on October 28, some bold investors are already eyeing Ford stock. However, the situation surrounding Ford stock remains shrouded in uncertainty.

Personally, I’m leaning towards the bearish side regarding F stock before the earnings call for a specific reason. Ford’s third-quarter 2024 vehicle sales figures are out, showing a mere 0.7% year-over-year increase from 500,504 to 504,039 units. This pales in comparison to the robust 7.7% year-on-year growth Ford exhibited in the same quarter of 2023.

Ford isn’t the sole Detroit-based automaker grappling with dwindling sales. Stellantis recently reported a staggering 20% dip in U.S. quarterly sales. The common thread seems to be concerns over vehicle affordability, raising doubts about the path forward for F stock.

Ford’s Self-Driving Conundrum

Another troubling sign on the horizon is Ford’s struggle to gain traction in the self-driving arena. The company recently announced a significant reduction in subscription prices for its BlueCruise hands-free driving technology, which offers advanced autonomous driving features.

With prices for monthly and annual BlueCruise subscriptions slashed from $75 to $50 and $800 to $495, respectively, alarm bells start ringing. The drastic price cuts hint at lackluster demand for BlueCruise, contrasting sharply with the industry’s enthusiasm for autonomous driving technology – a red flag for Ford’s competitive position against players like Tesla.

Analyst Insights: Is Ford a Buy?

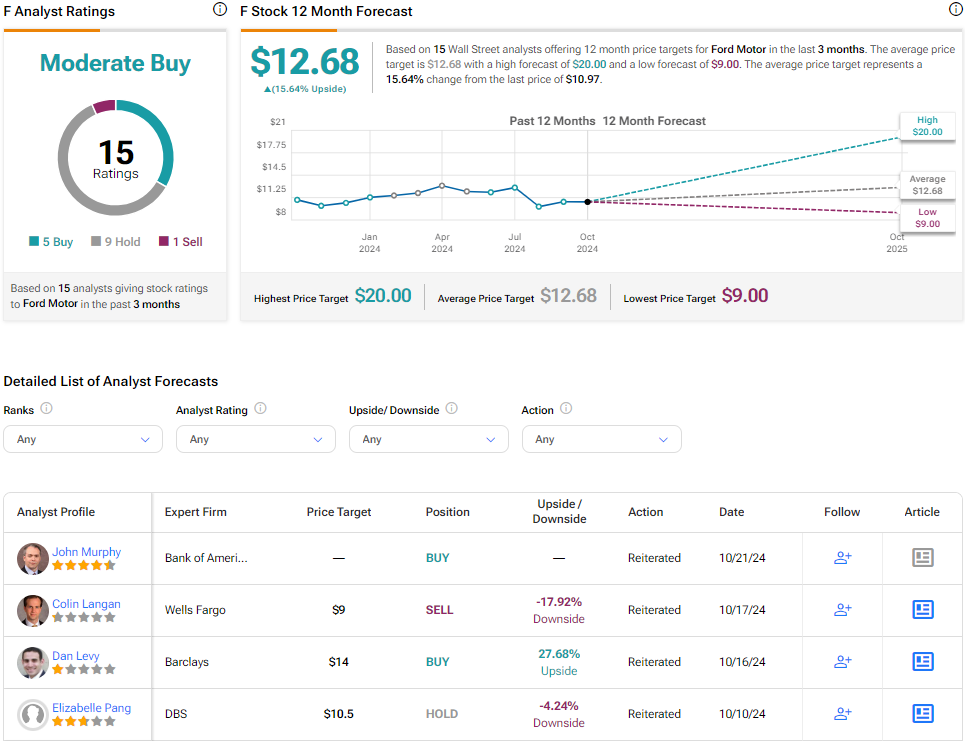

According to TipRanks, Ford stock holds a Moderate Buy rating based on a mix of five Buys, nine Holds, and one Sell in the past three months. The average price target for Ford Motor sits at $12.68, suggesting a potential upside of 15.64%.

If you’re contemplating which analyst to heed for Ford stock decisions, Michael Ward of Benchmark Co. stands out as the most accurate on a one-year timeframe, boasting an average return of 11.88% per rating with a 50% success rate.

Explore more F analyst ratings on TipRanks.

Final Verdict: Ford Stock Under the Microscope

The lukewarm sentiment from analysts and the woes surrounding Ford’s BlueCruise subscriptions paint a somewhat bleak picture. With the looming earnings event, where Ford’s slowing vehicle sales growth might be exposed, caution is the buzzword.

Ford is contending with challenges that cannot be overlooked, turning investments into a risky proposition. It may be wiser to wait for the third-quarter 2024 financial results before making any bold moves. As a cautious player, a bearish stance on F stock seems like the path of prudence, steering clear of a potential value-and-yield entanglement.