Tesla(NASDAQ: TSLA) achieved unprecedented success in 2023, breaking records in electric vehicle (EV) production and deliveries. Despite this, the company’s stock remains 39% below its peak, raising concerns about its future trajectory.

As the year concluded, Tesla ceded its status as the world’s top EV company to China’s BYD, highlighting the intensifying competition in the market. Additionally, doubts linger about the company’s ability to meet CEO Elon Musk’s ambitious growth projections.

Image source: Tesla.

Tesla Battles Economic Headwinds

The year 2023 presented formidable economic challenges, with the U.S. Federal Reserve implementing its fastest interest rate hikes in history. This move, aimed at curbing soaring inflation, led to subdued consumer spending, particularly on high-value items like automobiles.

Compounding Tesla’s woes, it faced heightened competition from BYD and traditional automakers like Ford Motor Company and General Motors, prompting the company to slash prices by an average of 20% over the course of the year to sustain sales targets.

While the price cuts managed to mitigate some competitive threats, they significantly impacted Tesla’s gross profit margins, diminishing its historically leading position in the industry.

Record Deliveries, But Growth Uncertainty

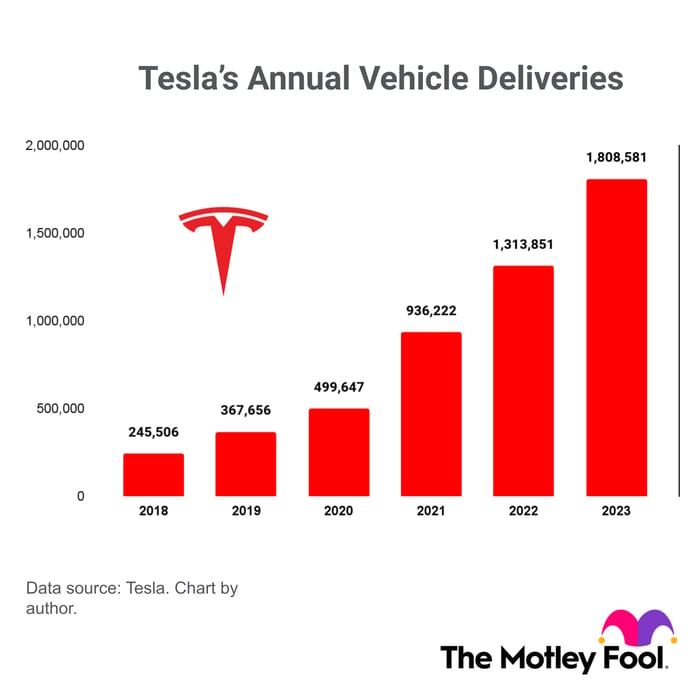

Despite these challenges, Tesla achieved a remarkable milestone by delivering a record 1,808,581 cars in 2023, reflecting a robust 38% growth compared to the previous year. However, concerns arise about the company’s ability to sustain this growth trajectory in the coming years, especially in light of Musk’s ambitious vision to ramp up production by 50% annually.

Early estimates for 2024 delivery projections suggest a more modest 21% increase, raising doubts about Tesla’s ability to meet Musk’s ambitious targets. The planned price cuts are expected to further dent Tesla’s earnings per share, leading to an elevated price-to-earnings (P/E) ratio, well above market norms.

Autonomous Technologies: A Beacon of Hope?

Nevertheless, Tesla’s foray into fully autonomous self-driving software presents a potential game-changing opportunity. The software’s ability to be developed once and leveraged multiple times offers a high-gross profit margin, through subscription-based sales to Tesla owners and potential licensing to other automakers.

Furthermore, Tesla’s ambitious plans for an autonomous ride-hailing network and the impending launch of a purpose-built autonomous robotaxi vehicle signal a shift toward high-margin revenue streams.

Cathie Wood’s Ark Investment Management projects that autonomous technologies could propel Tesla’s share price to $2,000 by 2027, marking an 816% increase from current levels—though such growth remains speculative at best.