The AI market is experiencing a boom, catalyzed by OpenAI’s ChatGPT introduction in November 2022. As per Grand View Research, the AI market is forecasted to expand at a compound annual growth rate of 37% through 2030, potentially exceeding a value of $1 trillion before the decade concludes. These escalating numbers present a golden opportunity for investment in AI-centric companies.

Two prominent contenders in this landscape are Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN), both extensively engaged and heavily investing in AI and cloud computing, a significant growth area for AI. Their aggressive strategic moves position them as formidable players, promising long-term gains.

Microsoft’s AI Initiatives

Microsoft made an early foray into AI with a $1 billion investment in OpenAI back in 2019, eventually securing a 49% stake in the startup. This collaboration granted Microsoft exclusive access to cutting-edge AI models, which have been integrated across its range of products, elevating its services with advanced AI technology.

Furthermore, Microsoft’s robust presence in the tech sector, as well as its implementation of OpenAI’s technology, positions the company for sustained superiority in the AI domain.

During the first quarter of 2024 (concluding in September 2023), Microsoft delivered a remarkable 13% year-over-year revenue growth, surpassing Wall Street estimates by nearly $2 billion. Particularly, its cloud and productivity segments exhibited revenue spikes of 19% and 13% respectively, emphasizing the company’s AI-centric focus, coupled with a substantial free cash flow of $63 billion last year, forging a promising growth trajectory.

Amazon’s Advancement in AI

Amazon orchestrated an impressive turnaround in 2023 post a 50% stock plunge the previous year. With its shares surging over 62%, the company reinvigorated its e-commerce business, alongside pivotal strides in AI adoption.

A series of cost-cutting measures fueled Amazon’s free cash flow, soaring by 427% to $16 billion. The restructured business predominantly directed its investments toward Amazon Web Services (AWS), the most lucrative segment, propelling it to a leading position in cloud computing, with a 32% market share.

Having achieved nearly $7 billion in profits in Q3 2023, AWS is well-positioned to capitalize on the expanding cloud market, amplified by the surge in AI adoption, fortifying Amazon’s stature as a prime AI investment.

The Better AI Stock: Microsoft or Amazon?

Both Microsoft and Amazon have emerged as quintessential AI behemoths, owing to their flourishing cloud businesses and prospective horizons in other tech realms. Considering their potential, the critical criterion for determining the superior AI stock is evaluating their current valuation.

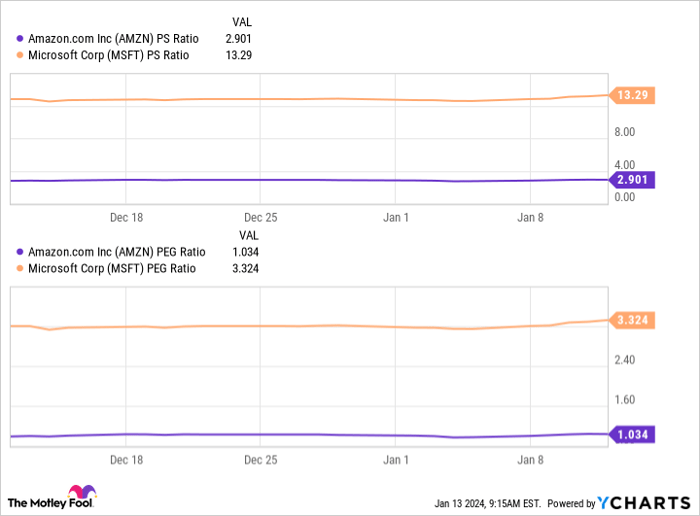

The price-to-sales (P/S) and price-to-earnings-to-growth (PEG) ratios of Amazon and Microsoft underscore their valuation perspectives. With Amazon’s stock offering a more attractive valuation compared to Microsoft, especially this month and commencing 2024, it emerges as the superior AI investment presently.

Data by YCharts. PS Ratio = price-to-sales ratio. PEG Ratio = price-to-earnings-to-growth ratio.

This comparative depiction of their valuation metrics advocates for Amazon as the preferred AI stock. Given the current market scenario, Amazon emerges as an opportunity ripe for the taking.

*Stock Advisor returns as of January 8, 2024.