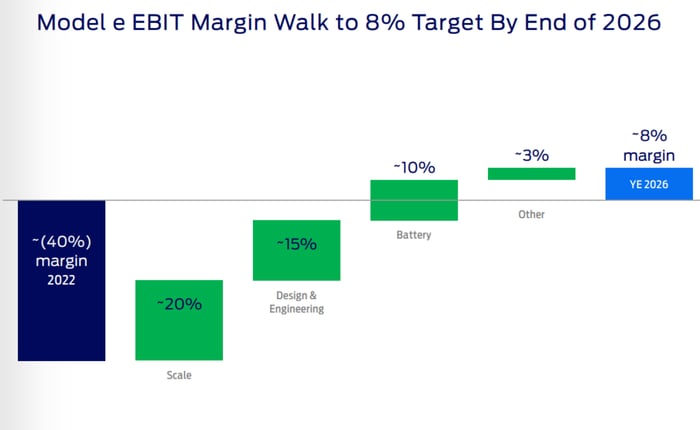

When investors think about Ford Motor Company (NYSE: F), a key consideration is the company’s potential to turn its $4.5 billion annual electric vehicle (EV) losses into profits by 2026. However, a recent development raises doubts about Ford’s ability to achieve this target within the specified timeframe.

An Abrupt Turn of Events

The F-150 Lightning, Ford’s best-selling EV pickup, experienced a 55% increase in sales in 2023, surpassing 24,000 vehicles. This model holds immense importance for Ford’s EV aspirations, particularly considering the substantial profits generated by Ford’s traditional F-Series trucks. The success of the F-150 Lightning is crucial for Ford’s EV profitability goal, further heightening concerns about the recent decision to reduce its production capacity.

Image source: Ford Motor Company

Significantly, scaling up operations is crucial to achieve profitability. However, the decision to cut production capacity for the F-150 Lightning, including a two-thirds reduction in jobs at its Michigan plant, raises concerns about the company’s ability to rapidly scale up its EV production and achieve profitability goals for its EVs by 2026.

Looking at the Bright Side

Although the reduction in F-150 Lightning production will delay Ford’s path to EV scale, the company intends to reallocate some of the displaced workers to increase production of the highly profitable Bronco SUV and Ranger pickup. Ford’s CEO, Jim Farley, emphasized the company’s commitment to balancing growth and profitability by leveraging its manufacturing flexibility to offer customers choices.

It is worth noting that the slower pace of achieving necessary EV scale may be attributed to the sluggish growth of the U.S. EV market. Ford’s ability to scale up its EV production rapidly is contingent upon the growth of demand in the market.

In the short term, the decision is expected to temporarily reduce Ford’s EV losses by focusing on the production of more profitable vehicles, given the substantial losses incurred on each EV sold by the company.

Ultimately, Ford’s recent move seems to be a strategic response to market dynamics. While EV sales continue to grow and hit a record volume in the fourth quarter, the pace of year-over-year growth is slowing down. This adaptive approach reflects the unpredictable nature of the automotive industry. Despite the near-term shifts, Ford is likely to achieve its Model e goals by the end of 2026, albeit with a different journey than initially envisioned.

Should you invest $1,000 in Ford Motor Company right now?

Before investing in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now… and Ford Motor Company wasn’t one of them. The 10 stocks identified could yield substantial returns in the years ahead.

Stock Advisor provides investors with a user-friendly plan for success, offering guidance on portfolio building, regular analyst updates, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 threefold since 2002*.

*Stock Advisor returns as of January 22, 2024

Daniel Miller has positions in Ford Motor Company. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.