Earnings season always offers a gripping peek behind the corporate curtain, a time when companies bare their financial souls to investors. The 2023 Q4 cycle looms large, a critical juncture where stakeholders eagerly seek insights into what lies ahead for 2024 and beyond.

Chipotle Mexican Grill

Chipotle Mexican Grill, a Zacks Rank #2 (Buy), operates fresh Mexican restaurant chains. In 2024, it demonstrated a healthy relative strength, a 1.5% climb while the S&P 500 dipped 0.4%.

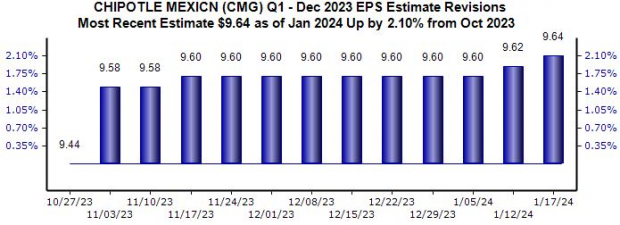

Buoyant analyst sentiment surrounds Chipotle’s release, with the $9.64 Zacks Consensus EPS Estimate 2% higher since October. This growth hints at a substantial 16% uptick from the same period last year.

Image Source: Zacks Investment Research

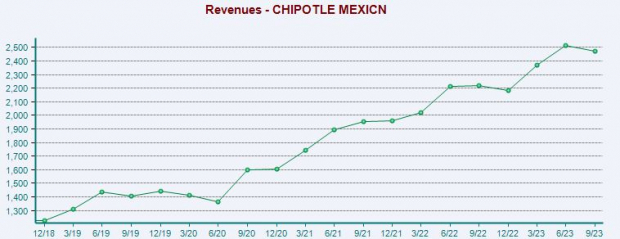

CMG’s expected top line expansion, a hefty $2.5 billion quarterly revenue estimate, implies a 14% climb—up 1.4% since October. The company has benefited from lower costs and sustained business momentum, fueling its robust growth.

Image Source: Zacks Investment Research

While CMG sports a lofty 44.1X forward earnings multiple, albeit below its 53.3X five-year median, investors have shown no qualms about paying a premium, given the company’s growth trajectory.

Netflix

Netflix, a Zacks Rank #2 (Buy), stands tall as a leader in online streaming. Its stock has surged in popularity over the past decade, evidenced by significant outperformance.

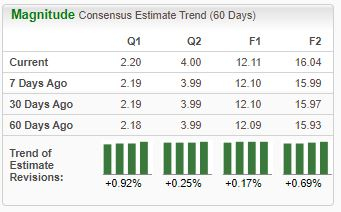

Image Source: Zacks Investment Research

The Zacks Consensus EPS Estimate of $2.20 reflects quadruple-digit year-over-year growth of over 1700%. Additionally, the $8.7 billion quarterly revenue estimate implies an 11% climb.

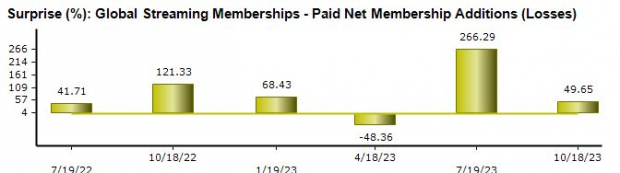

Notably, subscriber numbers are the key metric for investors. Paid Net Membership additions totaled 9 million in its latest release, surpassing expectations, buoyed by new ad-supported plans. Impressively, ad-supported memberships soared 70% quarter-over-quarter.

Image Source: Zacks Investment Research

MercadoLibre

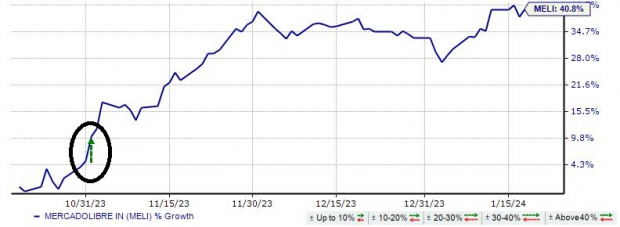

MercadoLibre, one of the largest e-commerce platforms in South America, is expected to post substantial growth, with consensus earnings and revenue estimates pointing to increases of 105% and 38%, respectively. MELI has consistently outperformed, exceeding consensus EPS expectations by an average of 33% over its last four releases.

Image Source: Zacks Investment Research

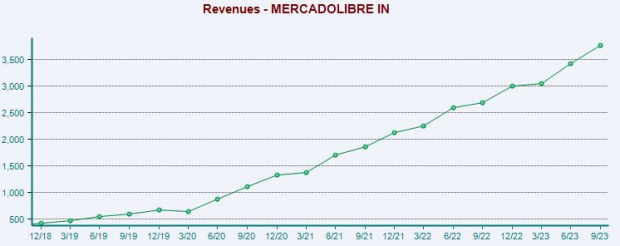

Much like CMG, MercadoLibre’s revenue growth has been robust, displaying double-digit year-over-year revenue growth rates in its last 13 quarterly releases.

Image Source: Zacks Investment Research

Bottom Line

Earnings season, though frenetic, is an exhilarating opportunity for investors to gain profound insights into company performance. Netflix, Chipotle Mexican Grill, and MercadoLibre are poised to delight investors, flaunting positive Zacks Earnings ESP Scores and a favorable Zacks Rank, signaling optimism among analysts.