Alibaba (NYSE: BABA), the Chinese e-commerce giant, encountered

ongoing struggles in 2023, as the anticipated recovery in the Chinese economy failed to materialize. The company

grappled with the continued loss of market share to PDD Holdings, and its plan to spin off non-core

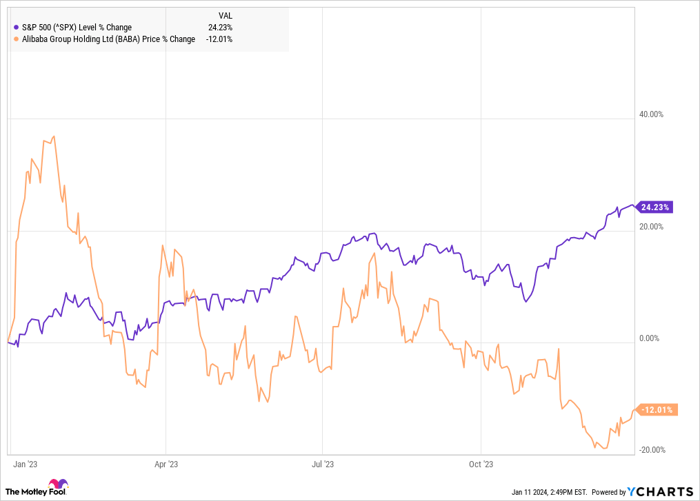

businesses was setback by new U.S. chip export restrictions. The unfavorable performance culminated in a 12% decline

in the company’s stock, according to data from S&P

Global Market Intelligence.

The stock displayed robust early momentum before relinquishing those gains and slumping throughout the remainder

of the year, as illustrated in the chart below.

The Downward Struggles of Alibaba

Alibaba’s stock initially surged at the beginning of 2023 with prevailing beliefs that the year would mark a resurgence

in Chinese stocks following the relaxation of the zero-COVID policy by the Chinese

government.

Additionally, investors appeared optimistic that Beijing’s crackdown on the tech sector had waned, and Goldman

Sachs even released a note predicting brighter times ahead for the Chinese tech giant.

However, the stock began to recede in anticipation of its February earnings report and continued to decline despite

a brief upswing upon reporting a mere 2% revenue growth for the December quarter. Notably, the company managed to

augment its earnings per share by 14% to $2.79 in the same quarter by effectively managing costs and driving efficiencies.

At the close of March, the stock regained ground following a proposal to disassemble the company into six businesses,

with the e-commerce division incorporating Tmall and Taobao remaining under Alibaba’s full ownership.

The stock relinquished these gains and remained volatile into the second quarter, as a surge following the release

of its March quarter earnings in May proved transitory.

Concerns about constraints on U.S. chip exports also seemed to bear down on the stock, as shares dwindled through

the majority of the third quarter.

In November, the stock nosedived as the company announced the termination of the planned spinoff of its cloud computing

business due to the impact of U.S. export restriction rules, which cast uncertainties over the future of Cloud

Intelligence Group. It was also stated that the anticipated spinoff would no longer create value for shareholders.

Image source: Getty Images.

Future Prospects for Alibaba

Alibaba stock has continued to decline in 2024, suggesting a challenging road to recovery. The Chinese economy’s persistent

weakness and the company’s diminishing market share to Pinduoduo and Temu-parent PDD Holdings, which has amassed

consumers through a deal-oriented model, are key contributing factors.

Yet, there is indeed a silver lining as Alibaba’s revenue growth appears to be showing signs of improvement. Nonetheless,

following several years of unexpected hurdles for the company, investors are seeking reassurance that it can achieve

enduring growth, free from external influences.

Should you invest $1,000 in Alibaba Group right now?

Before plunging into Alibaba Group’s stock, it is essential to contemplate this:

The Motley Fool Stock Advisor analyst team has recently identified what they believe are the 10 best stocks for investors to buy at present, and Alibaba Group was not on

the list. The 10 stocks deemed worthy could yield substantial returns in the years to come.

Stock Advisor offers investors an easy-to-follow roadmap to success, encompassing portfolio-building guidance,

regular analyst updates, and two fresh stock recommendations each month. The Stock Advisor service has

surpassed the S&P 500 return by more than threefold since 2002*.

*Stock Advisor returns as of January 8, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The

Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool recommends Alibaba Group. The

Motley Fool has a disclosure policy.