Volatility – a word that strikes fear into the hearts of many investors. The mere mention of it can send chills down their spines, conjuring images of wild market swings and financial instability. But there exists a select breed of traders who see volatility not as a threat, but as an opportunity. They dance in the storm, reveling in the chaos, knowing that within the tempest lies the potential for incredible gains.

Embracing Volatility: A Trader’s Tale

Jonathan Rose, a seasoned trader with over 16 years of experience in the trenches of major exchanges like the Chicago Mercantile Exchange and the Chicago Board Options Exchange, is one such individual. To him, volatility is not a beast to be tamed; it is a force to be harnessed.

Having witnessed fortunes made and lost in the blink of an eye, Rose understands the pivotal role that emotions play in trading. While most investors succumb to fear and greed during turbulent times, he has learned to thrive amidst the chaos by embracing three crucial elements: a winning strategy, the right tools for the job, and a steadfast plan to weather the storm.

The Path to Profit: Unleashing the Power of Options

For those seeking to capitalize on volatility, Rose extols the virtues of trading options. These financial instruments, often misunderstood and feared by the general public, offer a unique opportunity to magnify gains and limit losses in times of market upheaval. With options, traders can wield unparalleled leverage, compressing years’ worth of returns into a fraction of the time.

Contrary to popular belief, options need not be risky endeavors. Under Rose’s guidance, traders can employ fixed-risk strategies that safeguard against catastrophic losses while opening the door to outsized rewards. By judiciously navigating the world of options, investors can supercharge their portfolios and navigate the tumultuous seas of volatility with confidence.

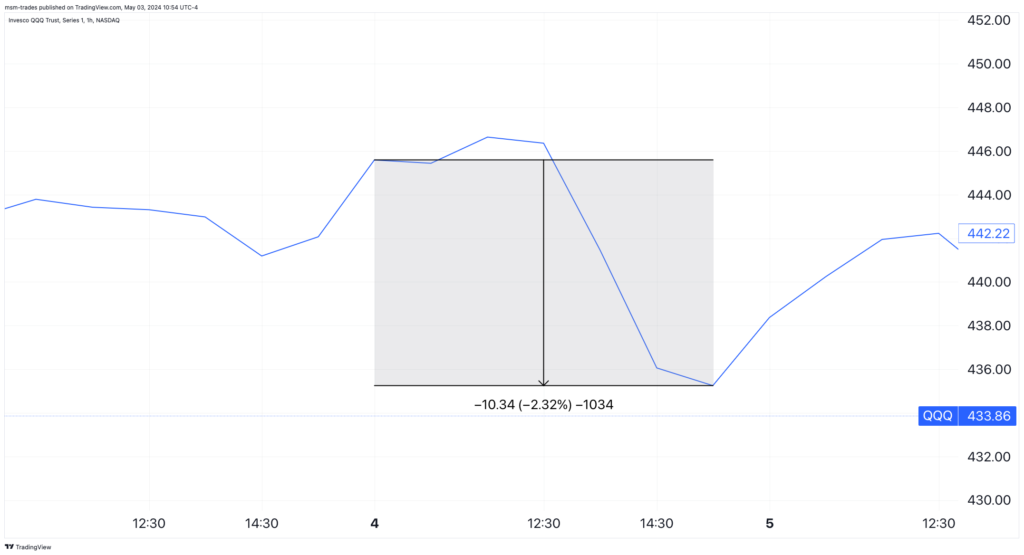

Take, for example, the case of Robinhood (HOOD). As shown in the price chart above, options offer a unique vantage point from which to capitalize on the ebb and flow of the market. While traditional investors may shy away from these financial instruments, those versed in the art and science of options trading can navigate the twists and turns of volatility with finesse, turning uncertainty into opportunity.