Palantir Technologies, the analytics software vendor, continues to captivate investors with its impressive revenue and earnings growth, setting the stage for strong debates among analysts in 2024. The company’s performance has been a mixed bag, leaving Wall Street divided on whether to classify Palantir’s stock as a “Buy,” “Hold,” or an outright “Sell.” Amid this financial tug-of-war, Palantir’s management champions the company’s transformative Artificial Intelligence Platform (AIP), aiming to unlock explosive returns for those bold enough to invest.

My optimism shines through when it comes to Palantir Technologies’ future potential, foreseeing significant returns over the next few years. Unlike its AI counterparts, Palantir showcases an impressive track record of consistent quarterly successes without hemorrhaging capital into new AI-related ventures. As analysts potentially warm up to the stock, which seems inevitable given recent trends, Palantir’s value could soar to unprecedented heights.

The Rise of AI in Palantir Technologies

Palantir’s CEO, Alex Karp, attributes the company’s recent successes to the introduction of the Artificial Intelligence Platform (AIP), a strategic move that has triggered a business metamorphosis. The AIP has enticed hordes of new commercial clients, leading to larger deal sizes and revitalizing Palantir’s once-stagnant Government revenue segment. In response to the AI revolution, government agencies are swiftly integrating novel AI tools into their daily operations, with a recent deal involving Microsoft potentially accelerating adoption rates.

A wave of AI innovation has revitalized Palantir’s core business, empowering customers to harness generative AI solutions tailored to their unique needs and visions.

The company’s success story is not just a tale of words. From a 12.7% year-over-year revenue growth rate in June 2023 to a staggering 27.2% year-over-year growth rate by June 2024, the numbers speak volumes. Net income margins have surged from 5.3% a year ago to nearly 20% in the most recent quarter, with a jaw-dropping 80% rise in normalized earnings per share. This thriving market environment prompted management to raise revenue and operating earnings forecasts twice for 2024, with first-half results surpassing even the loftiest expectations.

Palantir Technologies checks all the boxes for growth-focused investors. With a bright revenue and earnings trajectory, expanding earnings margins, and a cash-rich balance sheet holding a substantial $4 billion in cash, cash equivalents, and treasuries (comprising 77% of assets), the company’s potential for non-dilutive future investments is a promising prospect.

Despite its financial fortress, free from long-term debt, and boasting a strong free cash flow, Wall Street remains at odds regarding Palantir’s valuation.

The Debate: Split Analyst Views on PLTR Stock

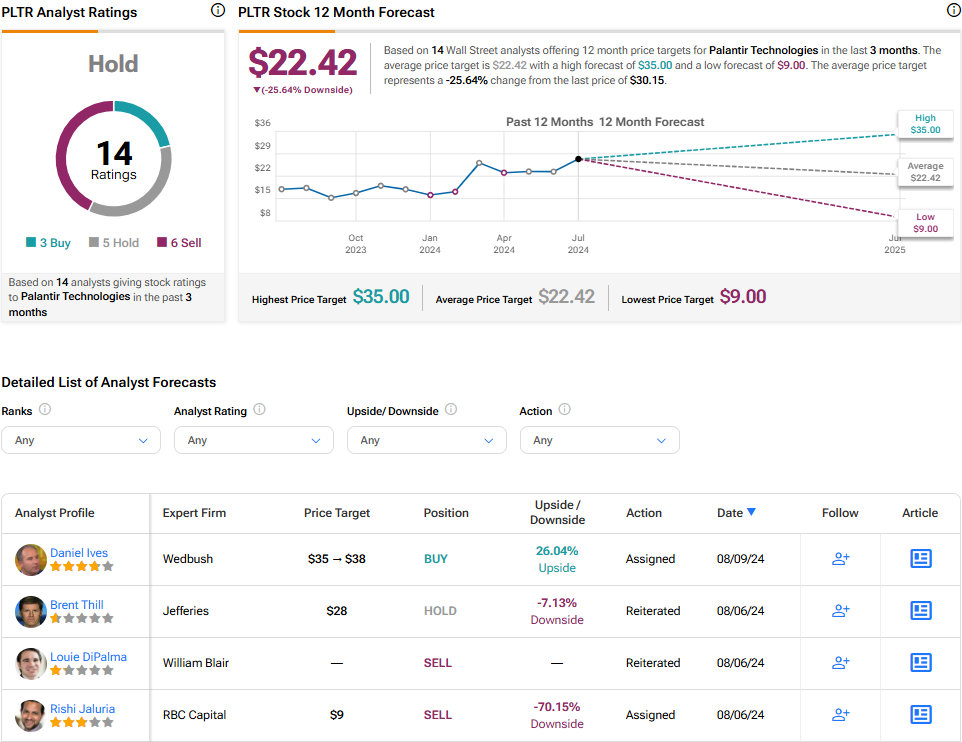

TipRanks data unveils a somber outlook for PLTR stock, with a mosaic of analyst opinions. Of the 14 analysts weighing in over the past three months, six advocate Selling, five suggest Holding, and a mere three recommend Buying this tech stock. This disparity culminates in a consensus Hold rating and an average PLTR stock price target of $22.42, indicating a potential downside of 25.6% over the upcoming year.

See more PLTR analyst ratings

Goldman Sachs’ analyst Gabriela Borges maintains a Hold rating on PLTR stock post-earnings, recognizing Palantir’s robust performance but expressing reservations about its valuation concerning similar peers’ growth rates.

In contrast, Wedbush’s Daniel Ives adopts a bullish stance, assigning a Buy rating and a $38 price target based on a surge in large corporate deals, a rise in commercial deals, and the resounding success of the Artificial Intelligence Platform.

Painting a bearish picture, William Blair’s Louie DiPalma stands firm on a Sell rating, citing perceived lagging growth rates and overvaluation relative to industry peer Snowflake.

Interestingly, the consensus rating on PLTR stock has shifted from a Moderate Sell earlier this year. Sustained stellar performance, especially through strategic collaborations akin to the recent Microsoft deal, could potentially justify the current premium on the stock, debunk the bear case, and sway Wall Street into a bullish fervor for Palantir.

Diving into Palantir’s Valuation

Palantir, as an exorbitantly priced growth stock, emerges from a 2022 distress to reclaim its past trading glory. With a trailing price-to-earnings (PE) ratio of 171.8x, nearly four times higher than the industry average of 44x, the stock stands lofty. Moreover, lofty anticipated growth rates peg its forward PE at 73x, a figure that continues to raise eyebrows. Yet, the valuation narrative unfolds beyond mere numbers.

Margin expansions, lucrative deals, and impressive revenue and earnings growth trajectories fuel optimism around Palantir stock long before fundamentals catch up.

When comparing Palantir to Snowflake, a common benchmark, the picture is clearer. While Snowflake grapples with persistent operating losses, Palantir has reported expanding operating margins for seven consecutive quarters. Investors may find justifiable paying a premium for a profitable growth stock with a proven track record.

My Thoughts on Palantir Stock: An Opportunistic Buy Ahead of an Analyst Consensus Shift

I find myself increasingly optimistic about Palantir Technologies’ unfolding growth narrative and might dip into some PLTR shares come September. The company seems to have cracked the code on deriving substantial revenue growth with minimal capital outlay through its winning AI-powered strategy. Earnings margins have blossomed, reflecting a more profitable venture compared to a year ago.

While valuation concerns loom, identifying the “perfect” comparable stocks remains a Herculean task, given Palantir’s distinctive AI offerings and a continually improving profitability schema.

Analysts may eventually pivot to a bullish stance on PLTR due to unwavering execution, expanding margins, and accelerating growth rates. Yet, Palantir’s ongoing resurgence from a 2022 slump may still keep analysts wary longer than warranted by underlying metrics. Nevertheless, an inevitable analyst upgrade could catapult Palantir stock to unprecedented heights.