When investors run through their mental catalog of the market’s biggest-ever winners, names like Nvidia and Amazon come to mind. And rightfully so. Nvidia’s tech is at the heart of most artificial intelligence (AI) platforms, while Amazon is largely responsible for ushering in the era of e-commerce. Their stocks’ millionaire-making gains are well justified.

There’s another less obvious name with a similarly impressive track record, however, that could continue dishing out oversize gains. That company is Broadcom (NASDAQ: AVGO). Here’s a closer look at why you may want to step into a long-term position in this ticker sooner rather than later.

What the heck does Broadcom do anyway?

In simplest terms, Broadcom makes a wide range of communications technologies. It’s technically been doing it since 1961, when it was still a division of Hewlett-Packard. The Broadcom name materialized in 1991, when the stand-alone entity was launched to capitalize on the opportunities being presented by the then-young broadband and networking industries. Another Hewlett-Packard spinoff company, called Avago, eventually acquired Broadcom in 2016, melding its wireless and wired communications tech offerings with Broadcom’s, although it obviously opted to use the Broadcom name.

So what does it actually manufacture now? Adapters that connect hard drives to motherboards, Wi-Fi antennas, router hardware, and fiberoptic connection solutions, just to name a few.

It’s not the hardware that makes Broadcom such a growth powerhouse, however. It’s the reason its technology is so desperately needed.

See, Broadcom’s tech is critical to data centers, and increasingly so thanks to the rapid growth of artificial intelligence.

Take, for instance, the serious slowdown experienced when transferring mountains of digital data from one processor to another within a wall of motherboard networked to another. Broadcom’s recently introduced Sian2 digital signal processors power past this problem by virtue of being able to handle data at an incredible rate of 200 gigabits per second per lane. What does this mean in layman’s terms? It’s a particularly important solution for generative AI platforms, which is emerging as one of the more marketable uses of artificial intelligence.

And that’s just a sampling of how quietly crucial Broadcom is to the still-growing artificial intelligence industry.

AI is driving great growth

Demand for such solutions isn’t apt to wane anytime soon either. In fact, it’s set to accelerate and persist for a while.

That’s the word from bond-ratings and investment researcher Moody’s anyway. Earlier this year it predicted that worldwide data center capacity would double over the coming five years. That expectation jibes with an outlook from Precedence Research suggesting that global spending on AI hardware is set to grow from last year’s $54 billion to $474 billion in 2034. This growth bodes well for Broadcom simply because its tech is so necessary to make the most of these big investments.

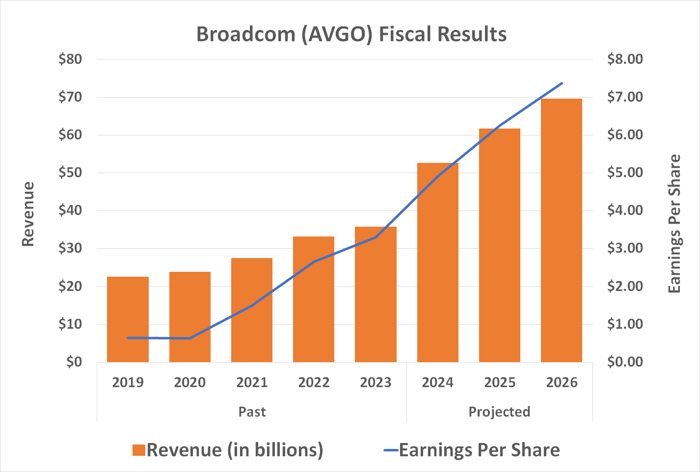

Investors won’t need to wait that long to benefit, though. While this year’s projected top-line growth of 44% is a bit out of the ordinary, the company is still likely to keep growing at a minimum of a double-digit pace for at least a few more years as the cost of AI continues to come down and the benefit of artificial intelligence tools firms up.

Data source: StockAnalysis. Chart by author.

And this outlook may understate what’s actually in store, if the company tiptoes into new slivers of the artificial technology market. As Mizuho Securities analyst Vijay Rakesh says of his recent decision to raise his price target on Broadcom from $190 to $220 per share, “Broadcom’s custom silicon business could see an opportunity of $16B or more if it wins OpenAl’s chip business, starting in the second half of 2025 or 2026.” Rakesh thinks the custom silicon market alone will eventually be worth $56 billion.

For perspective, Broadcom’s done just under $47 billion worth of business over the past four reported quarters.

Lots of upside ahead

While Broadcom stock’s 9,900% run-up since August 2009 (when Avago went public) is clearly a millionaire-making kind of move, don’t look for an exact repeat of the feat from here. This company was very much in the right place at the right time, ready for the advent of personal computers and mobile phones. These culture-changing developments have already happened, and as such won’t happen again.

That doesn’t mean the future isn’t bright, however. Even halving this historic gain to only 5,000% would still turn a $20,000 investment in Broadcom now into a seven-figure sum.

Of course, even if you don’t do that well, Broadcom’s still a fantastic growth investment, and a great way to plug in to the AI movement. Again, Precedence Research predicts that worldwide AI data center spending will swell from $54 billion in 2023 to $474 billion in 2034. That’s nearly a ninefold increase in the size of a market that would struggle to function without Broadcom’s solutions.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,991!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,618!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,922!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Moody’s, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.