Recent Performance Overview

In preparation for the Q4 earnings season, the financial sector is undergoing intense scrutiny, with Powerhouses like JP Morgan Chase (JPM) and Bank of America (BAC) set to herald Q4 earnings season.

However, shining brightly among the consumer lending stocks are Ally Financial (ALLY) and Synchrony Financial (SYF), both of which are teetering on their 52-week highs and are scheduled to report Q4 results later in January: on the 19th and 23rd, respectively.

As diversified financial service providers, Ally offers a comprehensive range of financial products and services mainly to the auto industry while Synchrony provides an extensive array of credit products through various national and regional retailers, local merchants, and manufacturers, among others.

While Ally has shown stellar stock performance over the past year with its shares up by an impressive 36%, Synchrony’s 17% increase has also been noteworthy. Notably, Synchrony hit 52-week highs of over $38 a share recently, and Ally is just shy of its $35.78 per share high last seen in February.

Image Source: Zacks Investment Research

Q4 Previews & Outlook

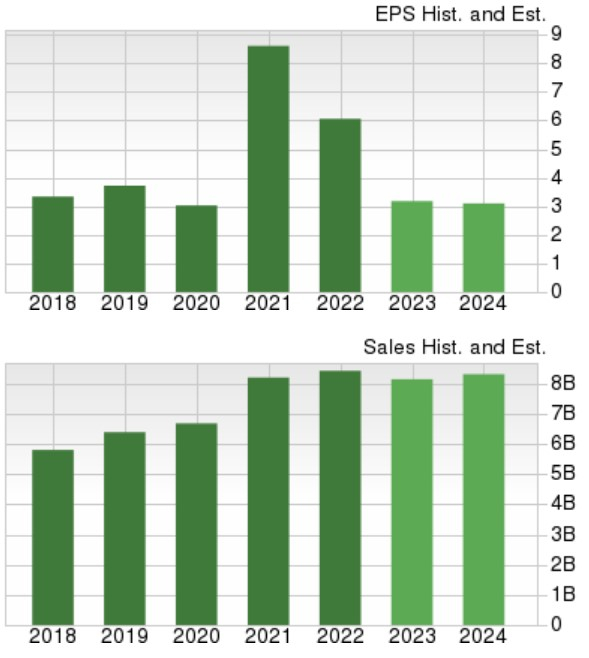

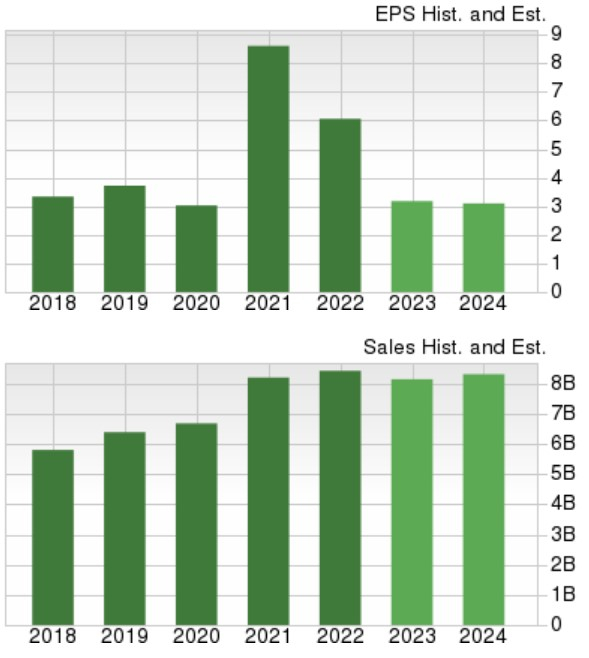

Ally and Synchrony are facing challenging Q4 earnings comparisons. Ally’s estimated fourth-quarter earnings are $0.51 per share, a decrease from $1.08 per share in Q4 2022. Similarly, Q4 sales for Ally are projected to drop by 9% to $2 billion.

Conversely, Synchrony’s fourth-quarter sales are expected to rise by 8% year on year to $4.45 billion. Nonetheless, its Q4 earnings are anticipated to decline by 22% to $0.98 per share compared to $1.26 per share in the comparative quarter. For Synchrony, the full-year 2023 EPS is expected to decrease by 16% to $5.13 per share, followed by a 7% rebound in FY24. Total sales are projected to rise by 7% over the year to $18.17 billion.

Ally’s annual earnings are anticipated to be $3.12 per share for FY23, compared to $6.06 per share in 2022, with an expected recovery of 14% in FY24 to $3.57 per share. Total sales for Ally are projected to decrease by 3% in FY23 and recover with a 2% rise in FY24 to $8.32 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Strong Value

Despite the apparent diminishing post-pandemic momentum in bottom-line figures, both stocks have witnessed a surge attributed to their reasonable valuations. Ally’s stock still trades at a very modest 10.8X forward earnings multiple, while Synchrony’s shares trade at just 7.3X. Ally provides a generous 3.5% annual dividend yield, and Synchrony’s 2.67% yield outperforms the S&P 500’s 1.4% average, offering greater value to investors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Takeaway

At present, Ally Financial and Synchrony Financial carry a Zacks Rank #3 (Hold). The potential for further growth may hinge largely on their Q4 results, but maintaining positions in these consumer finance leaders at their current levels may continue to be rewarding for investors.