Walmart’s WMT stock may have investors pondering as its three-to-one stock split approaches on Monday, February, 26. As part of Walmart’s evaluation of optimal trading and spread levels, WMT shares are expected to open at approximately $59 next week, compared to the current price of $177 a share.

With over 400,000 associates participating in Walmart’s stock purchase plan, the company aims to make shares more accessible, with retail investors also showing enthusiasm. Considering this, let’s delve into Walmart’s recent price performance and ascertain if its stock will be a bargain post the Q4 results announcement this week.

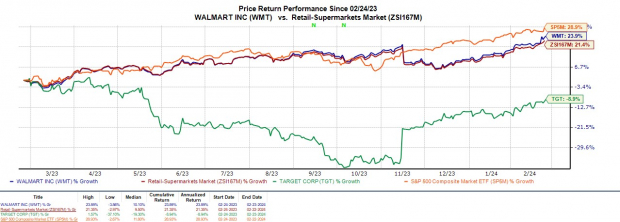

Recent Price Performance

Walmart’s stock has already surged +12% year to date, surpassing the S&P 500’s +6% and outperforming omnichannel peer Target’s TGT +7%. Over the past year, WMT shares have risen +24%, largely outpacing Target’s -9% and surpassing its Zacks Subindustry’s +21%, albeit slightly trailing the benchmark.

Image Source: Zacks Investment Research

Favorable Q4 Results Driven by E-commerce Sales

In its Q4 report released on Tuesday, Walmart delivered positive results for the broader retail industry as eyes turn towards Target’s earnings in early March. Bolstered by the festive shopping season, earnings of $1.80 per share surpassed the Zacks Consensus of $1.65 by 9%. Q4 earnings saw a 5% annual increase, with sales hitting $173.38 billion, up 5% from estimates of $170.63 billion.

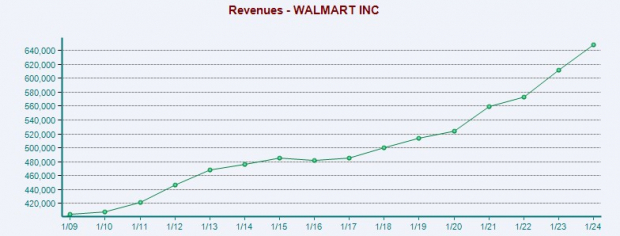

Image Source: Zacks Investment Research

Walmart’s robust quarter was fueled by the expansion of its e-commerce division, witnessing a 23% sales surge in Q4, propelling the company’s online sales to over $100 billion for the year. Overall, Walmart’s total sales grew 6% in fiscal 2024 to $648.1 billion, with annual earnings also increasing by 6% to $6.65 per share.

Image Source: Zacks Investment Research

EPS & Outlook Overview

Following the stock split, Walmart’s EPS is anticipated to decrease or dilute, given the increased number of outstanding shares. However, it is crucial to remember that the total earnings or net income of a company remains unaffected, similar to how revenue or sales are unaffected by this move.

Projections suggest a 3% growth in Walmart’s top line in FY25, with FY26 sales expected to rise by 4% to $698.5 billion according to Zacks estimates. Annual earnings are forecasted to increase by 5% in FY25 to $7.02 per share, translating to $2.34 per share post-split. Additionally, Walmart is anticipated to achieve a 9% EPS growth in FY26.

Image Source: Zacks Investment Research

Takeaway

Presently, Walmart’s stock sits at a Zacks Rank #3 (Hold) after a strong start to the year. The YTD surge in Walmart’s stock has been attributed to investors flocking to the shares in anticipation of an upward trajectory pre-split.While Walmart’s expanding e-commerce sector and long-term outlook are promising, there may be more favorable buying opportunities even post the stock split, as this doesn’t always translate to an immediate surge in share prices.