Investors often rely on Wall Street analysts’ suggestions to steer their investment decisions. But does the clairvoyance of these analysts truly shine through their ratings? Let’s delve into the realm of analyst recommendations regarding Celestica CLS and unravel the efficacy of these brokerage insights.

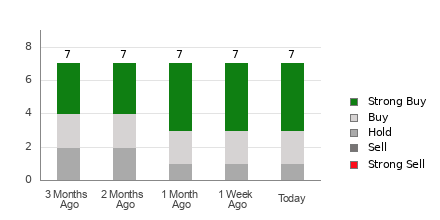

Currently, Celestica garners an average brokerage recommendation of 1.57, a figure sandwiched between Strong Buy and Buy on a 1 to 5 scale. This assessment is derived from the collective viewpoints of seven brokerage firms, with an inclination towards Strong Buy and Buy segments, occupying 57.1% and 28.6% of all recommendations, respectively.

The Mirage of Wall Street Recommendations for CLS

While the average brokerage recommendation sings the praises of Celestica, it’s prudent not to place all your investment chips solely on this verdict. History reveals that brokerage recommendations often crumble when attempting to forecast stocks’ price movements accurately.

Why, you might ask? Analysts employed by brokerage firms possess a natural bias towards positively tinting the stocks they cover. Research suggests that for every “Strong Sell” recommendation, there are usually five “Strong Buy” nods. This misalignment of interests implies that these recommendations do not always mirror the stock’s true trajectory. Hence, it’s advisable to supplement such data with robust research or a more predictive indicator, like the Zacks Rank.

Our acclaimed Zacks Rank, a battle-tested stock evaluation tool validated by external audits, segregates stocks into five bands, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), wielding the power to foretell a stock’s performance in the near term. Thus, juxtaposing the ABR with the Zacks Rank can serve as a beacon to guide informed investment choices.

Debunking the Myth: ABR vs. Zacks Rank

Despite sharing a common numerical scale, the ABR and Zacks Rank couldn’t be farther apart in essence.

ABR solely stems from brokerage estimations and is typically presented in decimal form, such as 1.28. Conversely, the Zacks Rank operates via a quantitative model reliant on earnings estimate revisions, portraying results in whole numbers ranging from 1 to 5.

The moral of the story? Brokerage analysts, driven by their firms’ interests, are inclined towards more favorable ratings than warranted by their analyses. Contrastingly, the Zacks Rank’s soul resides in earnings estimate trends, reflecting a robust correlation with stock price fluctuations.

Moreover, while the ABR might lag in freshness, the Zacks Rank’s agility shines bright. Analysts’ swift revisions to account for market dynamics ensure the Zacks Rank stays timely and responsive to imminent price shifts.

Is Celestica Truly a Gem?

Per the Zacks Consensus Estimate, Celestica’s prospects remain steady for the year, resting at $3.65 without any notable alterations in recent weeks.

Stable analyst sentiments revolving around earnings growth hint at Celestica’s alignment with broader market trends, securing it a Zacks Rank #3 (Hold).

With the stock’s modest consensus estimate tweaks, prudence behooves a cautious approach towards the Buy-tagged Celestica.

© 2024 Benzinga.com. Benzinga refrains from doling out investment counsel. All rights reserved.