Significant Milestone for Alibaba’s Lazada

Alibaba Group Holding BABA recently revealed that its Southeast Asian e-commerce platform, Lazada, hit a remarkable achievement by turning a profit in the month of July 2024.

Business Strategy Success

During a town hall meeting, CEO James Dong of Lazada shared that the company achieved positive EBITDA, signaling a significant step forward in its strategic roadmap, according to a report by SCMP.

Utilizing Advanced Technologies

The company has been capitalizing on AI-driven operations, enhanced online marketing strategies, customer incentives, and streamlined logistics to propel its growth trajectory.

Long-Term Growth Focus

Despite fierce competition in Southeast Asia, Lazada, which operates in multiple countries including Singapore, Indonesia, Malaysia, Thailand, Vietnam, and the Philippines, remains steadfast in its commitment to long-term growth and sustainability.

Challenges in the Market

While this achievement is notable, Lazada continues to confront stiff competition in the region, with Sea Limited’s Shopee holding the top position with a 48% market share.

Future Goals and Investments

Alibaba has injected around $7.4 billion into Lazada. Looking forward, Lazada has set its sights on achieving an annual gross merchandise value (GMV) of $100 billion by 2030.

Financial Growth

In the fourth quarter, Alibaba’s international commerce retail business revenue surged by 45% year over year to $3.80 billion, showcasing robust financial performance.

Market Challenges

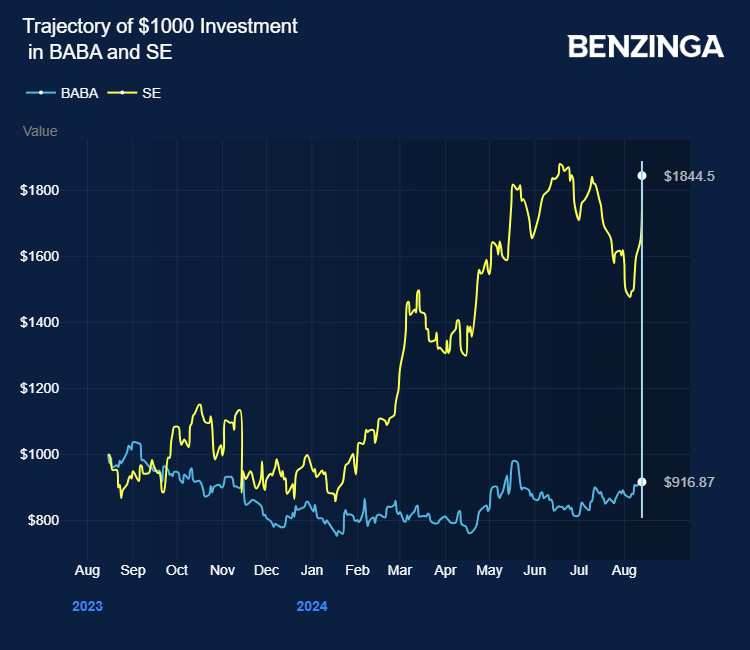

Alibaba Group Holding has faced a challenging period with its stock dipping over 13% in the past year due to intense domestic e-commerce competition in a sluggish economy.

Investment Opportunities

For investors seeking exposure to Alibaba Group Holding, options include the SPDR NYSE Technology ETF XNTK and the Invesco Nasdaq Internet ETF PNQI.

Current Stock Performance

Price Action: BABA shares were trading lower by 0.35% at $80.80 premarket at the last check on Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image by Quality Stock Arts via Shutterstock